Below is the third post in a series of blog posts called “Side Hustle Budgeting 101”. You can find the first post in this series here and the second post here. They feature special guest contributors who specialise in budgeting and finances. If you struggle with keeping your finances organized in your blog or side hustle, bookmark this to refer to later.

Thinking about diving into freelance work as a side-hustle or a full-time gig?

According to a 2014 survey on the state of freelance employment in America, now is the perfect time to explore freelance work.

Why now? The freelance market is huge. 34% of the United States population engage in some form of freelance work. And 77% of the freelancers surveyed reported they made a fairly lucrative wage.

[feature_box_creator style=”1″ width=”700″ top_margin=”5″ bottom_margin=”5″ top_padding=”5″ right_padding=”” bottom_padding=”5″ left_padding=”” alignment=”center” bg_color=”#75d7e1″ bg_color_end=”#0eb9cb” border_color=”” border_weight=”” border_radius=”” border_style=”” font_size=”14″ font_font=”Montserrat” font_shadow=”none”]

Don’t charge into freelance work. It’s imperative as a new freelancer that you understand your tax responsibilities as a self-employed individual before you get too far into your new freelance career.

[/feature_box_creator]

Table of Contents

Your Guide to Freelance Taxes (US Version)

Why do you need to understand the tax system (even if you’re only a part-time freelancer)?

The US tax law requires companies report money earned by their contracted workers to the Internal Revenue Service (IRS). Failure to report and pay taxes on all money earned can lead to audits and tax penalties.

In most cases, money earned from freelance work must be filed.

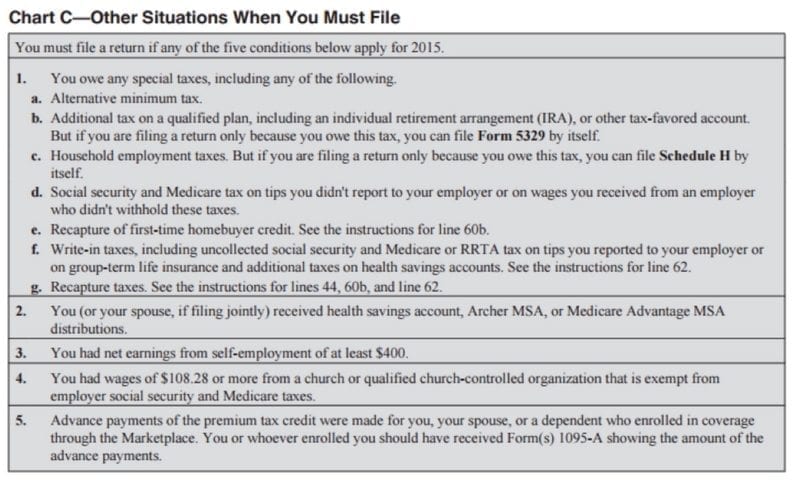

How do you know if you need to pay taxes on the money earned? Here’s a solid rule of thumb: if you earn $400 or more in freelance income, you must file a return. If you make less than $400, you might still need to pay taxes if you meet one of the other four requirements set by the IRS.

You might need to pay taxes more than once a year.

Salary or hourly employees in the United States are required to pay taxes annually by April 15th. Freelancers will either need to pay annually or quarterly.

Whether or not US freelancers need to pay taxes once or four times a year is dependent on how much they will be required to pay in taxes.

If you expect to pay at least $1,000 in taxes, you will be required to pay quarterly. ($1,000 in taxes is roughly a freelance salary of $5,000.) Failure to not report quarterly taxes will lead to a 6% to 8% additional penalty on the amount not paid on time.

Calculating Your Freelance Income

At a traditional job, you receive a W-2 form from your employer that outlines how much you earned over the past year. The W-2 equivalent for a freelancer or contractor is a 1099 form.

It’s vital that you do not rely on receiving these forms at the end of the year from companies or individuals.

There are two main types of 1099 forms: 1099-MISC and 1099-K. 1099-MISC is for independent contractors work. 1099-K is for contractors who receive payments via credit card through PayPal or other payment processors.

Companies only need to send out:

#1: 1099-MISC only needs to be sent out if the individual is paid more than $600 over the last year.

#2: 1099-K if the individual made more than $20,000 over the last year.

These days a large number of companies file their freelancers under the 1099-K form, so you should keep exact records of every freelance payment you receive.

Self-Employment Taxes

Self-employed and freelance taxes are comprised of two different taxes: self-employed contributions tax and income tax.

The self-employed contributions tax are comprised of your Social Security and Medicare payments. They tax makes up 15% of your freelance income.

[bullet_block style=”size-16″ small_icon=”11.png” width=”” alignment=”center”]

- You can utilize this Self-Employed Tax Calculator to get a sense of how much your yearly contributions will be.

- You file a Schedule SE form for the IRS.

[/bullet_block]

The income tax is based on your Adjusted Gross Income (AGI). AGI is total income, minus any deductions. Once you have your AGI, you will then calculate how much in taxes you will pay based on your tax bracket.

[bullet_block style=”size-16″ small_icon=”11.png” width=”” alignment=”center”]

- For Federal Income Taxes you will fill out Form 1040.

- You might also need to pay state or local income taxes on the amount. The forms and requirements vary.

[/bullet_block]

If the idea of filling out forms gives you a head out, you might want to invest in a tax software.

Paying Quarterly Taxes

In the US, quarterly taxes are not taxes on the amount earned each quarter. Instead, freelancers must guestimate how much they will make in the coming year and determine how much they must pay on taxes for that amount utilizing IRS Form 1040-ES. The sum they end up owing their federal and state government each quarter is one-fourth of the estimated amount.

In order to avoid either under or overpaying your quarterly taxes, you will:

[bullet_block style=”size-16″ small_icon=”11.png” width=”” alignment=”center”]

- Re-fill out the form to reflect any unexpected boosts or slumps in your freelance income.

- Subtract the amount already paid in taxes that year from the new estimated tax figure.

- Divide by the number of tax filing quarters that remain.

[/bullet_block]

The final April 15th tax period, you will need to submit the self-employment tax (Schedule SE) and income tax (Form 1040) forms. It is in this period that you will determine how much you under or overpaid.

If you underpaid, you might have to pay a penalty. Self-employed individuals can utilize the “safe harbor rule” to protect themselves from underestimating how much they will earn.

The safe harbor rule:

[bullet_block style=”size-16″ small_icon=”11.png” width=”” alignment=”center”]

- If you expect to make more than last year, you only need to pay 100% of what you paid in taxes the year before.

- If you make more than $150,000, you will be expected to pay 110% of what you paid in taxes last year.

- At the end of the year, you will calculate taxes owed and pay the amount you have not already paid.

[/bullet_block]

Paying Taxes as Part-Time Freelancer

If you have a non-freelance job, you can also your taxes by adjusting your W-4.

This will ensure your employer withholds a larger amount and avoid the need to save money for quarterly or annual taxes. It can also avoid the need to file quarterly taxes if you owe more than $1,000 in taxes.

The only downside is that you might not be able to ensure that too much or not enough is taken in taxes. If it’s the former, this can be hard for individuals living pay check to pay check. If it’s not enough, this could lead to penalties if you are required to pay quarterly.

Paying Annually

If you expect to pay less than $1,000 in taxes, you can wait to pay until the end of the year.

You will need to submit the self-employment tax (Schedule SE) and income tax (Form 1040) forms. If you historically utilized a tax software, you might just need to upgrade from the standard tax software to one that calculates freelance income.

I would recommend you calculate how much you owe a month or two before April 15th. The extra time will allow you to a month or two to come up with what you owe the IRS.

If you can’t pay in full by April 15th, you can set up a payment plan. The amount unpaid after April 15th will have late fees, though.

Starting a freelance side-hustle or career can be an exciting time. Don’t allow it to turn into a nightmare by waiting until the end of the year to worry about how you will pay the freelance portion of your taxes. With a little preparation, your freelance tax obligation will be a breeze.

[feature_box_creator style=”1″ width=”700″ top_margin=”5″ bottom_margin=”5″ top_padding=”5″ right_padding=”” bottom_padding=”5″ left_padding=”” alignment=”center” bg_color=”#75d7e1″ bg_color_end=”#0eb9cb” border_color=”” border_weight=”” border_radius=”” border_style=”” font_size=”14″ font_font=”Montserrat” font_shadow=”none”]

Author Bio: Samantha Stauf is a freelance writer with a speciality in finance writing. She writes for Intuit Quickbooks and you can connect with her on Twitter.

[/feature_box_creator]

[optin_box style=”12″ alignment=”center” email_field=”email” email_default=”Enter your email address” integration_type=”convertkit” double_optin=”Y” thank_you_page=”https://hustleandgroove.com/thanksforsubscribing” list=”42312″ name_field=”name” name_default=”Enter your first name” name_required=”N” opm_packages=””][optin_box_field name=”headline”][/optin_box_field][optin_box_field name=”paragraph”]PHA+PGEgaHJlZj0iaHR0cDovL3d3dy5odXN0bGVhbmRncm9vdmUuY29tL3dwLWNvbnRlbnQvdXBsb2Fkcy8yMDE2LzA0L0pPSU4tVEhFLUhHLVNFQ1JFVC1WQVVMVC5qcGciPjxpbWcgY2xhc3M9ImFsaWduY2VudGVyIHNpemUtZnVsbCB3cC1pbWFnZS0zNDYzIiBzcmM9Imh0dHA6Ly93d3cuaHVzdGxlYW5kZ3Jvb3ZlLmNvbS93cC1jb250ZW50L3VwbG9hZHMvMjAxNi8wNC9KT0lOLVRIRS1IRy1TRUNSRVQtVkFVTFQuanBnIiBhbHQ9IkpvaW4gdGhlIEgmYW1wO0cgU2VjcmV0IFZhdWx0IHRvZGF5ISIgd2lkdGg9IjcwMCIgaGVpZ2h0PSIzMDAiLz48L2E+PC9wPgo=[/optin_box_field][optin_box_field name=”privacy”]We value your privacy and would never spam you — that's just gross. You can unsubscribe at anytime.[/optin_box_field][optin_box_field name=”top_color”]undefined[/optin_box_field][optin_box_button type=”1″ text=”Access Now” text_size=”20″ text_color=”#ffffff” text_font=”Montserrat;google” text_bold=”Y” text_letter_spacing=”0″ text_shadow_panel=”Y” text_shadow_vertical=”1″ text_shadow_horizontal=”0″ text_shadow_color=”#0eb9cb” text_shadow_blur=”0″ styling_width=”20″ styling_height=”17″ styling_border_color=”#027381″ styling_border_size=”1″ styling_border_radius=”6″ styling_border_opacity=”100″ styling_shine=”Y” styling_gradient_start_color=”#0eb9cb” styling_gradient_end_color=”#027381″ drop_shadow_panel=”Y” drop_shadow_vertical=”1″ drop_shadow_horizontal=”0″ drop_shadow_blur=”1″ drop_shadow_spread=”0″ drop_shadow_color=”#027381″ drop_shadow_opacity=”50″ inset_shadow_panel=”Y” inset_shadow_vertical=”0″ inset_shadow_horizontal=”0″ inset_shadow_blur=”0″ inset_shadow_spread=”1″ inset_shadow_color=”#0eb9cb” inset_shadow_opacity=”50″ location=”optin_box_style_12″ button_below=”Y”]Access Now[/optin_box_button] [/optin_box]

2 replies to "A Guide to Paying Your Freelance Taxes 101 (US Version)"

This is EXACTLY what I needed! So happy to have come across it! Thank you so much for taking the time to write it! 🙂

You’re welcome Jamie!